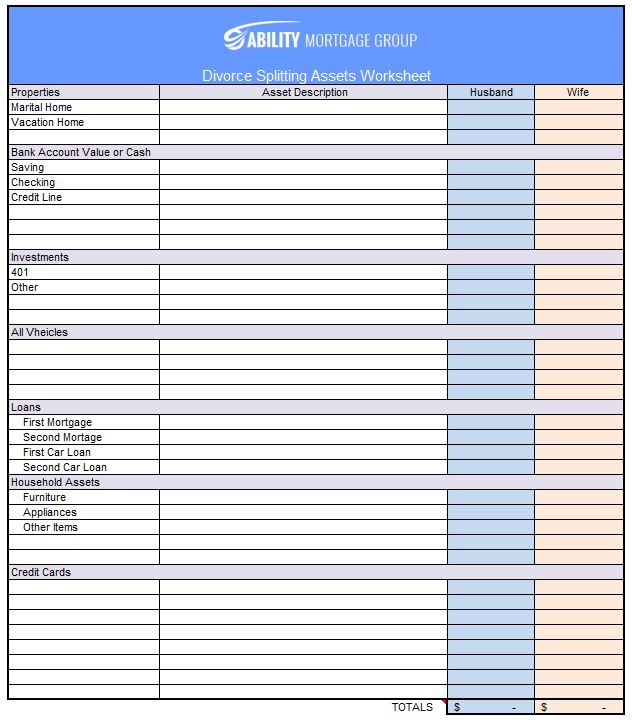

A conversation about a divorce is usually an awkward one since no one plans on getting it. Dividing property you have acquired over the years is painful. But when you are ready to part ways with your partner, you have to get on with dividing your debts and assets. This Divorce Splitting Assets Worksheet hopefully will help you with things such as making negotiations with your spouse and/or their lawyer, attaching the sheet to the final agreement, and weighing your options. for any assistance contact our team of professional mortgage lenders at 410-827-5111

You wouldn’t want to divide every debt or asset equally – this worksheet prevents that. Also, it enables one to fill in all the debt and/or property (joint and separate!) and give it to the partner who fancies it. The spouses will then see which of them gets more money after entering all the things they own. It will be easy to identify the spouse that gets the better deal, and to find out if either if the spouses should give the other a certain amount so everyone gets a fair share.

When major assets like retirement and pension plans, stock options, restricted stock, deferred compensation, professional practices and licenses, rental property, houses, closely-held businesses, and brokerage accounts are involved, dividing the family’s property can be a serious issue.

It can be quite difficult to determine who gets what even when things seem straightforward. If you’re having a contentious divorce, it can slow down the whole process further.

Dividing assets on the basis of the current value (in dollars) is not necessary. You have to look at the long-term and short-term financial security of the assets you are getting. In most cases it’s normally difficult to tell the real value when you haven’t done enough research on the asset. Things to focus on include any tax implications that come with its sale, the cost basis and its liquidity.

It’s difficult to divide property that you’ve accumulated over time.When you’re ready to divorce your partner, though, you’ll need to start dividing your debts and possessions.This Divorce Assets Splitting Worksheet should assist you in negotiating with your spouse and/or their lawyer, attaching the document to the final agreement, and considering your options.

I’ve owned my company for just under 20 years and have roughly 6,000 customers. With so many customers throughout the years, we do, unfortunately, get calls each month from clients who need to refinance to remove someone from the deed because of a divorce or separation. This is why I want to talk about your options when you are going through a divorce and need to buy out a spouse.Some banks that I work with require a separation agreement as well as a divorce decree already in place and recorded. But there are also banks that don’t require this documentation if you’re divorcing and want to buy out your spouse; the title company can handle it. In the event that it’s not amicable and one person has moved out of state, I can settle half of it here in Maryland and then the other portion in that state. We try to make it as painless and as simple as possible.If this situation comes up for you or you know anyone else who’s going through this, we would love the opportunity to help. More often than not, though, our customers have already ironed everything out and split up without expensive lawyers being involved. They just want to buy out the spouse and take care of it, which we can help them do without the separation agreement or divorce decree in place.

If this situation comes up for you or you know anyone else who’s going through this, we would love the opportunity to help. I’ve done hundreds of these refinances and know how to handle it whether it is amicable or not. Of course, I can also keep you informed with things you will need to consider, such as getting a check back for the escrows, because when you refinance someone off of a mortgage, you could end up with a $3,000 to $5,000 check.

Contact the Ability Mortgage Group to get help you sort out the best for your financial future.